Wonders Of Credit Card Validation API For Your Business

More and more APIs (Application Programming Interfaces) are being created as technology develops to assist simplify and automate certain operations. The Credit Card Validation API, which is used to validate credit card data, is one such API that has grown in popularity. We’ll go through what an API is, why you should use one, and how the Credit Card Validation API functions in this article.

How Do APIs Work?

An API, or application programming interface, is a collection of tools and protocols that enable communication between various software programs. Simply put, an API enables developers to interface with certain features of an application or service without having to write complicated code. APIs can be used to construct completely new applications or to automate specific processes, combine various systems, and so forth.

Why Use An API?

For developers, using an API can have a variety of advantages. Building an application, can, among other things, save a lot of time and work. Developers can simply use the API to make calls and receive data rather than having to create all the code necessary to interface with a service. Scalability and flexibility are two additional benefits of using APIs, which are simple to update or modify as needed. Moreover, APIs can enhance security by limiting access to specific features and data.

The Credit Card Validation API: What Is It?

Information about credit cards is verified via an API called the Credit Card Validation API. It determines whether a credit card number is legitimate and whether the card type matches (Visa, Mastercard, American Express, etc.). For e-commerce websites, payment gateways, and other programs that process credit card transactions, this API is especially beneficial.

Using the Credit Card Validator – BIN Checker API has a number of advantages, one of which is that it can aid in preventing fraudulent transactions. The API can verify credit card data to make sure the transaction is real and lower the possibility of chargebacks and other problems.

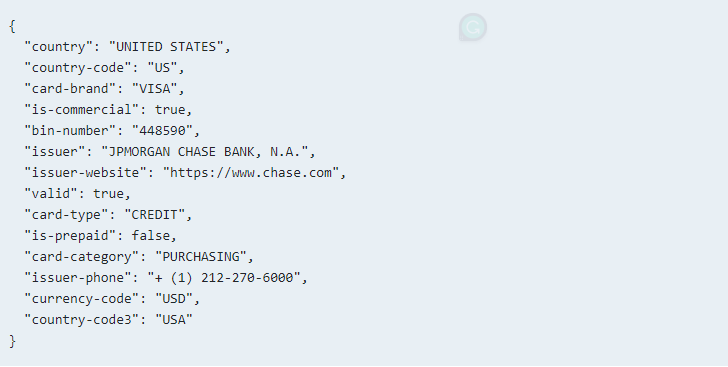

To retrieve the complete information of this BIN/IIN in JSON format, you must supply a BIN (Bank Identification Number), which is the first six digits of a credit or debit card. You will be informed of the card’s validity, the issuing bank, and the place where the card was issued.

The Credit Card Validator – BIN Checker API: How Does It Operate?

There are several endpoints that you can discover and depending on which one you choose the response will vary, but this is the API response model in JSON format:

To determine whether a particular credit card number is valid, the Credit Card Validator – BIN Checker API sends a request to a credit card issuer’s database. The first few digits of the card number can also be used by the API to determine the type of card.

To make use of it, you must first:

1- Go to Credit Card Validator – BIN Checker API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.