Why Integrate A Transaction Validation API Into Existing Systems?

Are you looking for a way to improve the security of your existing systems? You should try integrating a transaction validation API! In this article, we’ll tell you more about it and how to get one.

In the world of e-commerce, security is always a top priority. It is important to be able to trust that transactions are legitimate and secure. This is where transaction validation APIs come in. These APIs allow you to quickly and easily validate transactions to ensure that they are safe and secure. They can also help you to identify fraudulent transactions and protect your business from theft or fraud.

There are a number of different transaction validation APIs available, each with its own unique features and benefits. These APIs can be used to verify transactions both online and offline, as well as across different systems and platforms. They can also be used to track and monitor transactions for a variety of purposes, such as account monitoring or anti-money laundering compliance.

There are many reasons why you might want to integrate a transaction validation API into your existing systems. One reason is to make your systems more secure. A transaction validation API can help you to ensure that all transactions are valid and legitimate. This can help to protect against fraud and other forms of abuse.

Another reason is to make your systems more efficient. A transaction validation API can help you to streamline your systems by reducing the need for manual checks and approvals. This can save you time and money, while also improving the overall efficiency of your systems.

Check out this API if you’re looking for an API that verifies transactions!

If you’re looking for an API that can verify transactions, then look no further than the Transaction Validation API. This API can help you to quickly and easily verify any transaction, so you can be sure that your payments are secure and reliable.

How does the transaction validation APIs work?

Transaction validation APIs are a way for you to verify that a transaction is valid before you accept it. This can help you to avoid accepting fraudulent or invalid transactions, which can protect your business from fraud or theft.

Overall, transaction validation APIs can help you to protect your business from fraud by ensuring that all transactions are valid and legitimate. If you’re looking for a way to improve the security of your existing systems, then a transaction validation API is a great option.

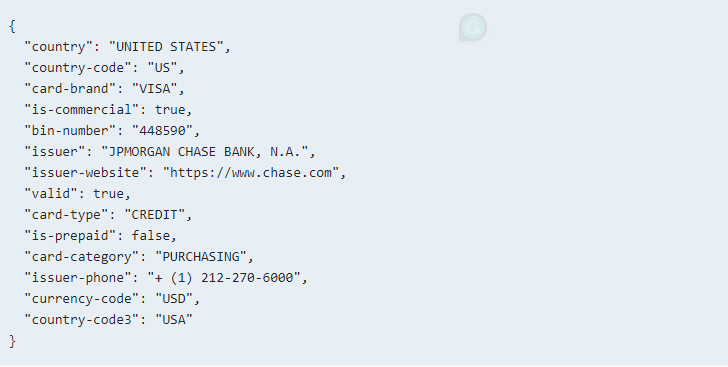

The user will send the credit/debit card (Bank Identification Number) or IIN (Issuer Identification Number) to get the full details.

You have to provide a BIN (Bank Identification Number) – the first 6 digits of a credit/debit card, to receive the full details of this BIN/IIN in JSON format.

You will receive the card’s validity if it’s VISA or MASTERCARD, what is the issuing bank, and the card’s issuing location.

To make use of it, you must first:

1- Go to Credit Card Validator – BIN Checker API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.

If you found this post interesting and want to know more, continue reading at https://www.thestartupfounder.com/understanding-the-value-of-an-anti-fraud-api/ />