The Taxes API: You Can Easily Dive Into The World Of Taxation

Do you want to enter the world of taxation? Do it with this Tax API!

The word “tax” is a term we use daily. We pay taxes when we buy something, when we receive a paycheck, etc. But what exactly is a tax?

The taxes that a company must pay are known as corporate taxes. Federal, state, and local governments impose corporate taxes on businesses, including corporations and partnerships, to finance public projects.

Corporate taxes are generally assessed based on the income of the business. Corporate tax rates are determined by the federal government and vary based on the income of the company.

Corporate taxes can be divided into two categories:

Current tax, which is due for the current year. And there is also the deferred tax. This is the tax that was due in prior years and was not paid at that time.

There are three types of corporate taxes: income tax, which is a tax on the income of companies. It is calculated by subtracting the allowable deductions from the tax base and then applying a corporate tax rate to the remainder.

Property tax is a tax levied on the property of corporations. It can be imposed either as an annual fee or as a per-unit property fee. There is also the sales tax that is imposed on sales made by corporations in an area. If you want to immerse yourself in the world of taxation, you can use a Taxes API.

What Are The Most Common Use Cases For This API?

This API is ideal for businesses that sell products and/or services online and need to calculate sales tax based on customer location. Also, if you want to calculate your taxes later, this will be very useful for you. Be sure to use it!

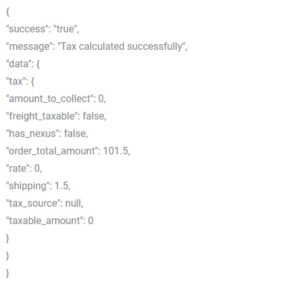

What Does This API Receive And What Does Your API Provide (input/output)?

To verify any tax percentage, all you need is the shopper’s or shopper’s ID, both of which can be found on their profile pages or in any transaction. You will receive an object with all this data.

To make use of it, you must first:

1- Go to The Taxes API and simply click the “Sign up for free” button to start using the API.

2- After registering on the Zyla API Hub, you will be provided with your API key. Using this unique combination of numbers and letters, you will be able to use, connect and manage the APIs!

3- Use the different API endpoints depending on what you are looking for.

4- Once you meet your required endpoint, make the API call by pressing the “execute” button and see the results on your screen.

Why Taxes API?

With this TaxesAPI you can find useful information. This API will allow you to obtain all the information you need about taxes in your country. You can also use it to get information about all the countries where this API is available. You can use it in any programming language you prefer to incorporate into your website and apps.