Making Sense Of A Tax Calculator API

Do you want to know how to make sense of a tax calculator API? In this post, we explain how to do it and which is the best.

The tax burden each person pays is determined by several factors, including the type of income earned and the amount earned. Taxpayers are required to pay a certain percentage of their income to the government in the form of taxes.

The calculation of this percentage is based on the amount of income earned and the tax rate. The tax rate is the percentage of income paid to the government in taxes.

Tax Types

Income tax, for example, is a percentage of your income that you must pay to the government. The amount of tax you must pay depends on your income and other factors, such as whether you are married or single and whether you have children.

Corporate Tax is a percentage of your company’s income that you must pay to the government. The amount you must pay depends on your income and other factors, such as whether you are a corporation or a limited liability company.

VAT, also known as Value Added Tax, VAT is a consumption tax levied on goods and services at various stages of production. The final consumer pays the tax when purchasing a product or service. The amount of VAT paid by each company varies depending on their supply chain and whether they are registered for VAT.

There may also be a special tax that is a percentage of your income that you must pay to the government. The amount you must pay depends on your income and other factors, such as whether you are an individual or a corporation.

On the other hand, there is a tax on donations. This is a percentage of your donation that you must pay to the government. The amount you must pay depends on your donation and other factors, such as whether it is cash or property.

With all this information, it’s clear that taxes can be tricky to calculate. But you don’t need to worry because there are APIs available that can help you make things simple.

How Do I Use A Tax Calculator API?

There are many different APIs available for calculating taxes, but if you want to save time and effort, try using an API to calculate them. This will allow you to quickly calculate the tax rate for any city without having to do any calculations yourself. In this case, use TaxesAPI.

To make use of it, you must first:

1- Go to The Taxes API and simply click the “Sign up for free” button to start using the API.

2- After registering on the Zyla API Hub, you will be provided with your API key. Using this unique combination of numbers and letters, you will be able to use, connect and manage the APIs!

3- Use the different API endpoints depending on what you are looking for.

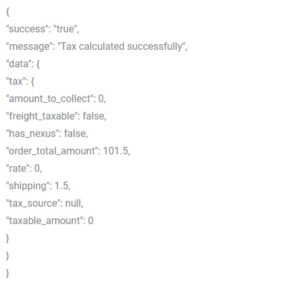

4- Once you meet your required endpoint, make the API call by pressing the “execute” button and see the results on your screen.

Why Tax API?

With TaxesAPI you will get information about the sales tax rates of each country so you can easily compare them. If you want to make sense of a tax calculator API, we recommend using the tax API. Start using it today!