How To Use The Credit Card Validation API For Maximum Security

Are you trying to verify credit cards quickly and easily? Did you know that the greatest of artificial technology can be combined with the newest API technology to make this process simpler? To discover everything about it, read this article.

Why Credit Card Validation APIs Are Necessary?

Security is a primary concern of any business or individual that utilizes online credit card transactions. With the rise in online fraud, it is increasingly important to ensure that the data is transmitted securely and that the data is valid. This is where the Credit Card Validation API can help.

What These APIs Are

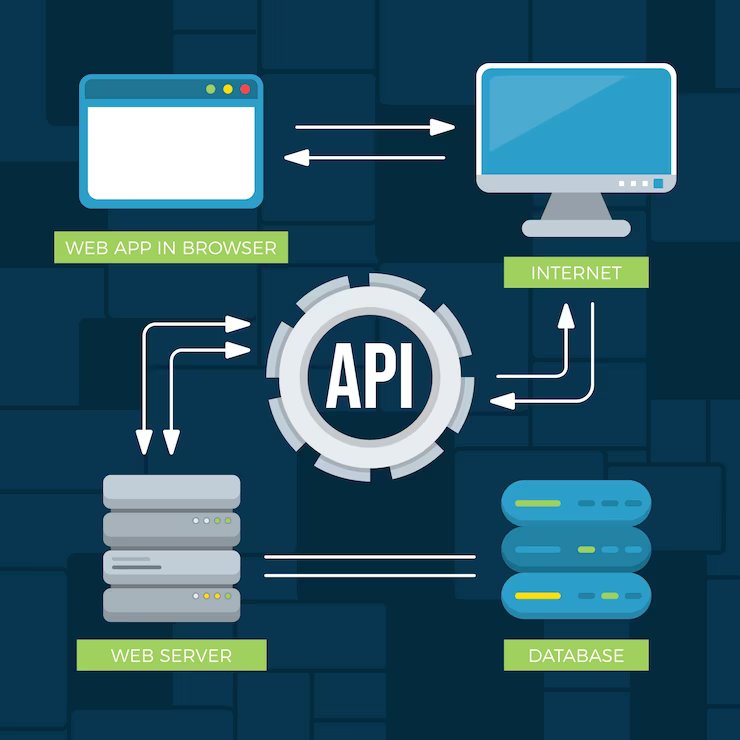

An Application Programming Interface (API) is a set of instructions and protocols that allow two or more applications to communicate with each other. In the case of the Credit Card Validation API, it is a set of web services that allows developers to access and use a range of credit card validation services.

The Credit Card Validation API is designed to validate credit card information, including the credit card number, expiry date, CVV, and other details. It can also detect and prevent credit card fraud by verifying information such as the cardholder’s name, address, and phone number. This helps to ensure that the card is not being used fraudulently.

The API also provides a range of features to help developers ensure maximum security. For example, it can detect if a card has been reported as lost or stolen, and it can also verify if a card is valid or not. This means that developers can have peace of mind when it comes to using the API to process credit card transactions. Among the existing ones, we recommend the popular Credit Card Validator – BIN Checker API.

There are several endpoints that you can discover and depending on which one you choose the response will vary, but this is the API response model in JSON format:

Why The Credit Card Validator – BIN Checker API?

Using the Credit Card Validator – BIN Checker API helps to reduce the cost of processing payments. By verifying information in real time, developers can make sure that the payments are secure and that the data is valid. This saves time and money, as it eliminates the need for manual checks.

Another benefit of using the Credit Card Validator – BIN Checker API is that it can be used to detect and prevent fraud. With the API, developers can detect if a card is being used fraudulently by monitoring the IP address of the user, the type of card being used, and the amount of the transaction. This helps to reduce the risk of fraud and the amount of losses incurred.

Overall, the Credit Card Validation API is an invaluable tool for developers who need to process payments securely. It can help to reduce the cost of processing payments, detect and prevent fraud, and ensure that the data is valid. By using this API, developers can ensure maximum security when it comes to online transactions.

How Can You Use This API?

You can use this API in a few simple steps:

1- Register with Zyla Labs’s Anti-fraud API marketplace.

2- Get your unique token by registering your application

3- Add the token to your authorization header

4- Make the call and wait while the system responds

As you can see, it is very simple to use this anti-fraud API.

This anti-fraud tool is available in multiple languages and is easy to integrate into your existing systems or processes. It’s also easy to use and affordable, so there’s no reason not to give it a try.

If you liked this post and want to know more about this, keep reading at https://www.thestartupfounder.com/check-if-a-given-phone-number-is-valid-or-not-with-this-api/ />