How To Prevent Fraud With A Credit Card Validation API

Are you looking for a quick and simple credit card verification? Did you know that to streamline this process, the best artificial technology can be integrated with the most recent API technology? Read this article to learn all about it.

Why Do We Need Credit Card Validation APIs?

Any company or person using online credit card transactions has security as their top priority. It is becoming more crucial to make sure that the data is delivered safely and that it is accurate as online fraud increases. The Credit Card Validation API can be useful in this situation.

What Are These APIs?

A collection of guidelines and protocols known as an Application Programming Interface (API) enables two or more apps to communicate with one another. Developers can access and use a variety of credit card validation services through the Credit Card Validation API, which is a collection of web services.

A credit card’s number, expiration date, CVV, and other parameters can all be verified using the Credit Card Validator – BIN Checker API. By confirming details like the cardholder’s name, address, and phone number, it can also identify and stop credit card fraud. This makes it easier to prevent fraudulent usage of the card.

Why The Credit Card Validator – BIN Checker API?

The API offers a number of features as well to aid developers in ensuring the highest level of security. For instance, it can determine whether a card has been reported lost or stolen and check to see if it is still valid. This implies that developers can use the API to conduct credit card transactions with confidence. We advise the well-liked Credit Card Validator – BIN Checker API among the ones already available.

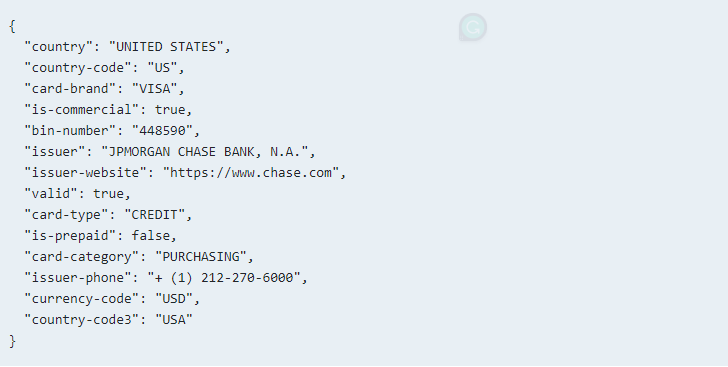

There are several endpoints that you can discover and depending on which one you choose the response will vary, but this is the API response model in JSON format:

Processing fees are decreased by using the Credit Card Validator – BIN Checker API. Developers can ensure that the data is accurate and the payments are secure using real-time data validation. As there is no longer a need for manual checks, this saves both time and money.

The ability to identify and stop fraud is another advantage of using the Credit Card Validator – BIN Checker API. By tracking the IP address of the user, the kind of card being used, and the size of the transaction, developers can use the API to determine whether a card is being used fraudulently. By doing this, fraud risk and financial losses are reduced.

Overall, developers who need to securely process payments will benefit greatly from the Credit Card Validator – BIN Checker API. It can aid in lowering payment processing costs, spotting and preventing fraud, and guaranteeing the accuracy of the data. Developers may guarantee the highest level of security for online transactions by using this API.

To make use of it, you must first:

1- Go to Credit Card Validator – BIN Checker API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.