Here’s Why Financial Companies Use APIs For Bank Data

Do you want to know why financial companies use bank data APIs? In this article we will explain you why and which is the best API for bank data.

When you have a bank account, you have entered into a contract. The bank agrees to hold your money in trust, and you agree to pay interest on any loans you take out and to pay the bank back on time. The bank’s contract with its customers is known as a “deposit agreement.” Deposit agreements are legally binding contracts between a bank and a customer.

In this case, APIs are very useful for financial companies. These tools allow companies to integrate all of their information into a single system. This way they can develop new products and services more quickly while reducing costs and errors.

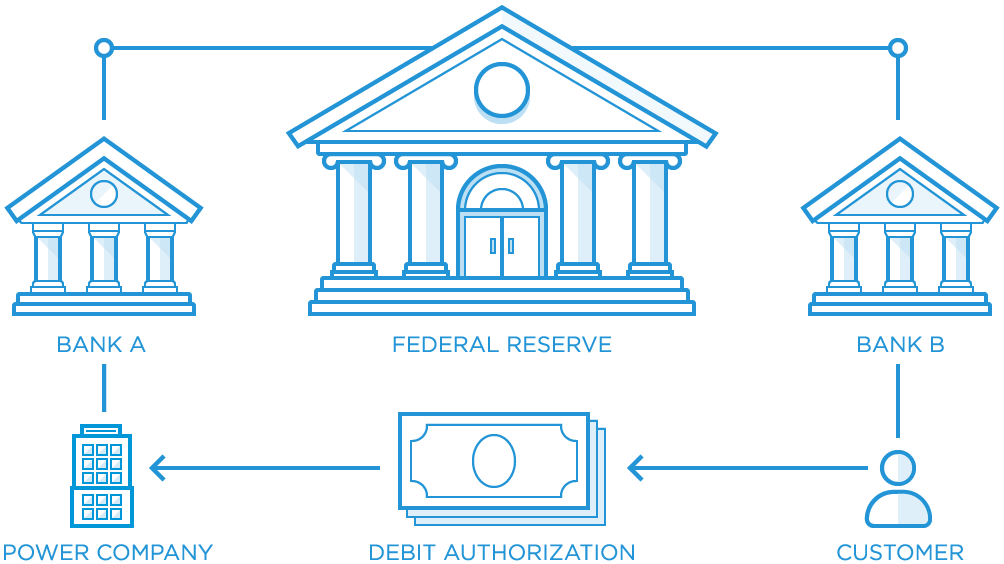

APIs are interfaces that allow two different systems to communicate with each other. They are used by many types of businesses, including banks, but also by platforms such as Facebook or YouTube that offer different types of content. APIs can be used to integrate different types of data into your platform while also allowing external users to access that data.

Why Do Financial Companies Use Bank Data APIs?

Financial companies use APIs for many reasons. First, they allow companies to integrate data from other systems into their own platforms and applications. This can be useful for many purposes, such as improving customer service or developing new products and services. APIs can also be used to access data from other companies, which can be useful for many purposes, such as market research.

In this instance, we’re discussing the Routing Number Bank Lookup API since we want to discuss the most accurate API currently available online. This API offers simple-to-understand information on banks.

You will be able to gather a variety of data about any bank worldwide using this API. You’ll be able to find out information like your phone number, address, and other ways to get in touch with you. Use this API immediately because it is the most accurate one on the market at the moment.

Some of the best use cases of this API are:

Validate your provider’s routing number: With this API you will have the opportunity to validate the routing number of your provider before making any transactions.

Recognize the bank associated with the routing number: You will be able to determine where the account is located. You will have access to the bank information.

Get bank information: You will get additional information about the bank to make any quick call to check anything you need.

To make use of it, you must first:

1- Go to Routing Number Bank Lookup API and simply click on the button “Subscribe for free” to start using the API.

2- After signing up in Zyla API Hub, you’ll be given your personal API key. Using this one-of-a-kind combination of numbers and letters, you’ll be able to use, connect, and manage APIs!

3- Employ the different API endpoints depending on what you are looking for.

4- Once you meet your needed endpoint, make the API call by pressing the button “run” and see the results on your screen.