Add Tax Calculator API To Your Finance Website

Are you trying to find a good tax calculator API for your finance website? You should try this one!

To determine how much tax you owe on your income or how much you will recover from your deductions, you will need to use a tax calculator. A tax calculator is a tool that helps you calculate your taxes quickly and easily. You can use a tax calculator to estimate your taxes for the current year or for prior years (for example, if you are filing an amended return).

There are many different types of tax calculators, and each one is designed for different tasks. In this article, we’ll discuss the most common types of tax calculators and explain how they work.

How Do Tax Calculator APIs Work?

An API is an application programming interface that allows two software systems to communicate with one another and exchange data in a standardized way. APIs can be used for a variety of purposes, including creating new applications and integrating existing applications with other systems.

In this case, tax calculators are computer programs that are designed to calculate taxes based on input from a user. Information is usually entered into the program in the form of numbers.

However, some programs can also accept text or images. The program then calculates the taxes due based on this input data and returns the results to the user.

Tax calculators are often used by businesses and individuals to calculate their taxes due or any potential refunds they may owe. They can be used for both federal and state taxes and can be used for both income and sales taxes.

Tax calculators can be used for both personal and business purposes. Businesses can use them to calculate their corporate taxes, while individuals can use them to calculate their income taxes.

There are many different types of tax calculators available, but they all work the same way.

How Do I Use It?

Using a tax calculator is straightforward. First, you’ll need to find a reliable online tax calculator. There are many online, so make sure you choose one that is reputable and trusted. Here we recommend Taxes API.

To make use of it, you must first:

1- Go to The Taxes API and simply click the “Sign up for free” button to start using the API on a seven-day free trial.

2- After registering on the Zyla API Hub, you will be provided with your API key. Using this unique combination of numbers and letters, you will be able to use, connect and manage the APIs!

3- Use the different API endpoints depending on what you are looking for.

4- Once you meet your required endpoint, make the API call by pressing the “execute” button and see the results on your screen.

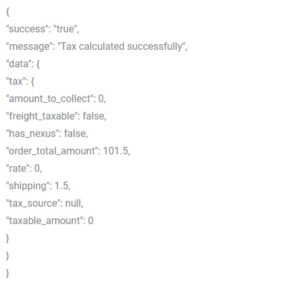

Here’s an example API response:

About Taxes API

Businesses are often required to use tax calculators to determine the amount of tax they owe or the amount of a refund due to them. Taxes API can be used to calculate any type of tax, including income, sales, and property taxes. They can also be used to determine the number of tax-deductible expenses. You can integrate the API response into your digital content using various programming languages. Programmers around the world love it because it allows them to integrate easily into financial websites.