A Tax API To Save Time And Money

A tax API to save time and money is a great tool. If you want to know more about it, keep reading.

Many people around the world worry about paying their taxes. That is very good because it guarantees the transparency of a company or a person towards society. However, many times they are not clear about which taxes are relevant, especially if they have to move to a city that they are not used to. There they have to start taking the time to find out what they are. And it can take a lot of time.

For this reason. taxes APIs are becoming more and more popular. This is because they make filing taxes easier and faster. By using a tax API, you won’t have to spend time searching for the right information or filling out forms. Instead, you can simply provide the API with some basic information and it will do all the work for you. There are several tax APIs available, but not all are created equal. Some are more accurate than others, some are easier to use, and some are more affordable. But first, let’s see what an API is.

Use An API

An API is a programming interface used to transfer data from one device to another. In this way, you can develop various functions in your app or website. The API is very useful for developers as it is like a kind of pre-programmed document. In other words, programmers do not need to do their work from scratch, but they can gradually incorporate responses from the APIs to develop their content. This is why the API helps you automate processes. Consequently, you manage to reduce the amount of time and money invested in a job. In this case to calculate taxes quickly we recommend TaxesAPI. It is very easy to use:

1. Enter Zyla API HUB and generate your username and password.

2. Go to Taxes API and generate your API call key.

3. select the programming language and the city you are searching for and press “ok”

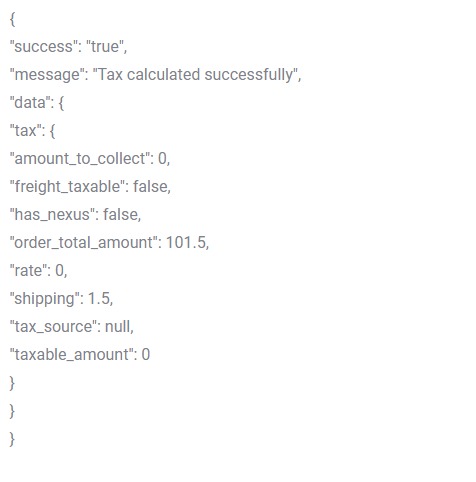

4. You will get your response that will be something like this:

What Is The Tax API?

Taxes API is a simple and easy-to-use tool that can help you save time and money when filing your taxes. It is a web-based application that connects to the IRS website and allows you to quickly and efficiently retrieve tax information from the IRS.

The TaxesAPI is also very accurate, which means you can be sure that your taxes will be filed correctly. And since it’s web-based, it’s also very easy to use.

Just create an account, log in, and start using it! Tax API offers several features that make it ideal for both personal and business use. It supports CSV and JSON formats. It’s also very flexible: you can choose how often you want your data to be updated, be it daily, weekly, or monthly. In this way, you will always have the most up-to-date tax information at your disposal.